Should I Pay for Insurance Kakobuy A Comprehensive Guide for Shoppers

Related Recommendations

We hope this guide has provided you with the insights needed to answer the question: should I pay for insurance Kakobuy? Happy shopping!

Remember, insurance is not a one-size-fits-all solution. Weigh the pros and cons, assess your risk tolerance, and decide what makes the most sense for you. Whether you choose to invest in peace of mind or opt to save on additional costs, the key is to shop smart and stay informed.

Michael R., a bargain hunter: “I shop a lot during sales and prefer to save on insurance costs. My credit card offers purchase protection, so I rely on that instead.”

Pros of Purchasing Insurance on Kakobuy

- Peace of Mind: The primary advantage of buying insurance is the reassurance that your purchase is protected. Knowing you have coverage if something goes wrong can significantly reduce shopping anxiety.

- Financial Protection: In the unfortunate event that your package is lost or damaged, insurance can save you from financial loss. This is particularly beneficial for high-value items.

- Simplified Claims Process: Insurance often comes with a streamlined claims process, making it easier to get compensated compared to dealing directly with the vendor or shipping company.

Cons of Purchasing Insurance on Kakobuy

- Additional Cost: The most apparent downside is the extra cost. While it might be a small percentage, it can add up if you’re a frequent shopper.

- Limited Coverage: Not all insurance policies are created equal. Some may have exclusions that limit their effectiveness, such as not covering certain types of damages or specific products.

- Redundancy: If you’re already covered by other forms of insurance, such as credit card purchase protection, buying additional coverage might be redundant.

Factors to Consider Before Purchasing Insurance

To make an educated decision about whether to pay for insurance on Kakobuy, consider the following factors:

Conclusion: Should You Pay for Insurance Kakobuy?

The decision to pay for insurance on Kakobuy ultimately depends on your individual circumstances and preferences. By considering the value of your purchases, the potential risks, and your existing coverage, you can make an informed choice that aligns with your shopping habits and financial goals.

Should I Pay for Insurance Kakobuy? A Comprehensive Guide for Shoppers

In the fast-paced world of online shopping, where convenience and variety rule supreme, services like insurance have become a hot topic. If you’ve ever shopped on Kakobuy, you might have encountered the option to purchase insurance for your items. But the question remains: should I pay for insurance Kakobuy? In this article, we’ll delve into the ins and outs of this decision, providing you with practical advice and insights to help you make an informed choice.

- Value of the Item: For expensive purchases, insurance might be a wise investment. However, for low-cost items, the additional protection might not justify the cost.

- Shipping Distance: If your package has a long journey ahead, the risk of damage or loss might be higher, making insurance more attractive.

- Vendor Reliability: Research the vendor’s reputation. If they have a history of reliable deliveries and good customer service, you might feel safe skipping insurance.

- Existing Coverage: Check if your credit card or other insurance policies offer purchase protection. If they do, additional insurance might be unnecessary.

Practical Tips for Making Your Decision

Here are some practical steps you can take to decide whether or not to purchase insurance on Kakobuy:

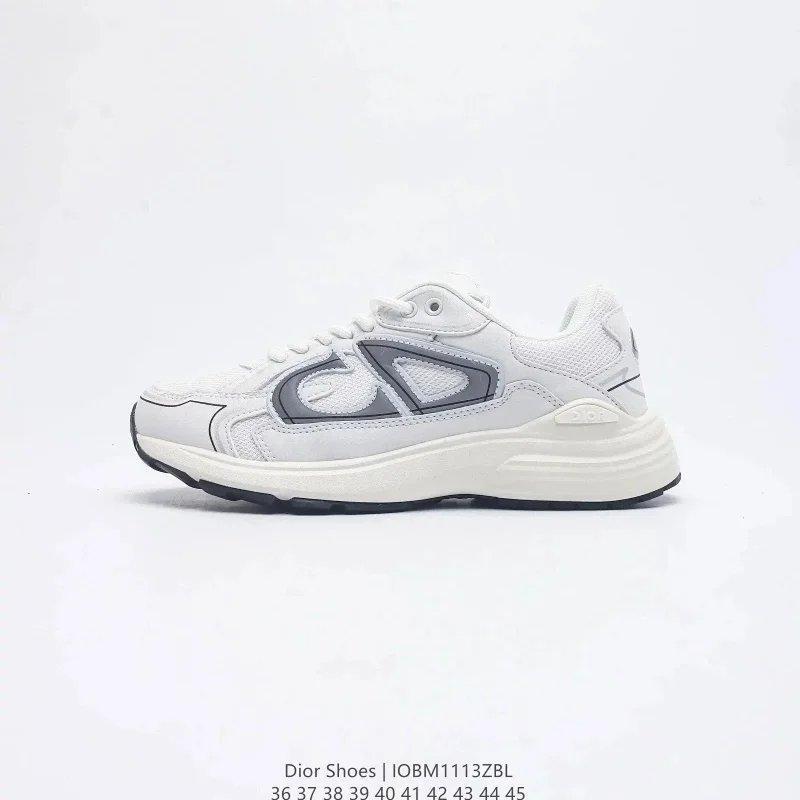

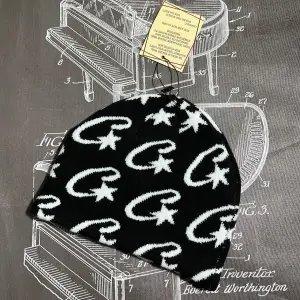

Susan L., a frequent fashion buyer: “I skip insurance for clothing since it’s relatively inexpensive and easy to return. I’ve never had issues with lost packages, so it’s a risk I’m willing to take.”

Understanding Kakobuy Insurance

Before deciding whether to invest in insurance, it’s crucial to understand what it actually offers. Kakobuy’s insurance typically covers scenarios such as lost shipments, damages during transit, and sometimes even returns. Essentially, it’s a safety net designed to protect your purchases from unforeseen mishaps.

Insurance fees are usually a small percentage of your total purchase price, which may seem negligible at first glance. However, the cumulative effect on frequent shoppers can add up, making it essential to weigh its benefits against its costs.

- Read the Fine Print: Carefully review the terms and conditions of the insurance policy. Understanding what is covered and what isn’t is crucial.

- Compare Policies: If Kakobuy offers multiple insurance options, compare them to determine which provides the best value and coverage for your needs.

- Consider Your Shopping Habits: Reflect on your shopping frequency and the types of items you usually purchase. Frequent buyers of high-value items might benefit more from insurance.

- Evaluate Risk Tolerance: Consider your personal risk tolerance. If you’re someone who prefers to play it safe, insurance might be worth the peace of mind it offers.

Real-Life Experiences: What Other Shoppers Say

Hearing from fellow shoppers can provide valuable insights. Here are some real-life experiences from Kakobuy users:

John D., a tech enthusiast: “I always buy insurance for electronics. Once, my package was lost, and the insurance made it easy to get a refund. For me, it’s worth the extra cost.”